what is suta tax rate

2 days agoSince federal income tax rates go up to 37. Lets say your business is in New York where.

Payroll Software Solution For Massachusetts Small Business

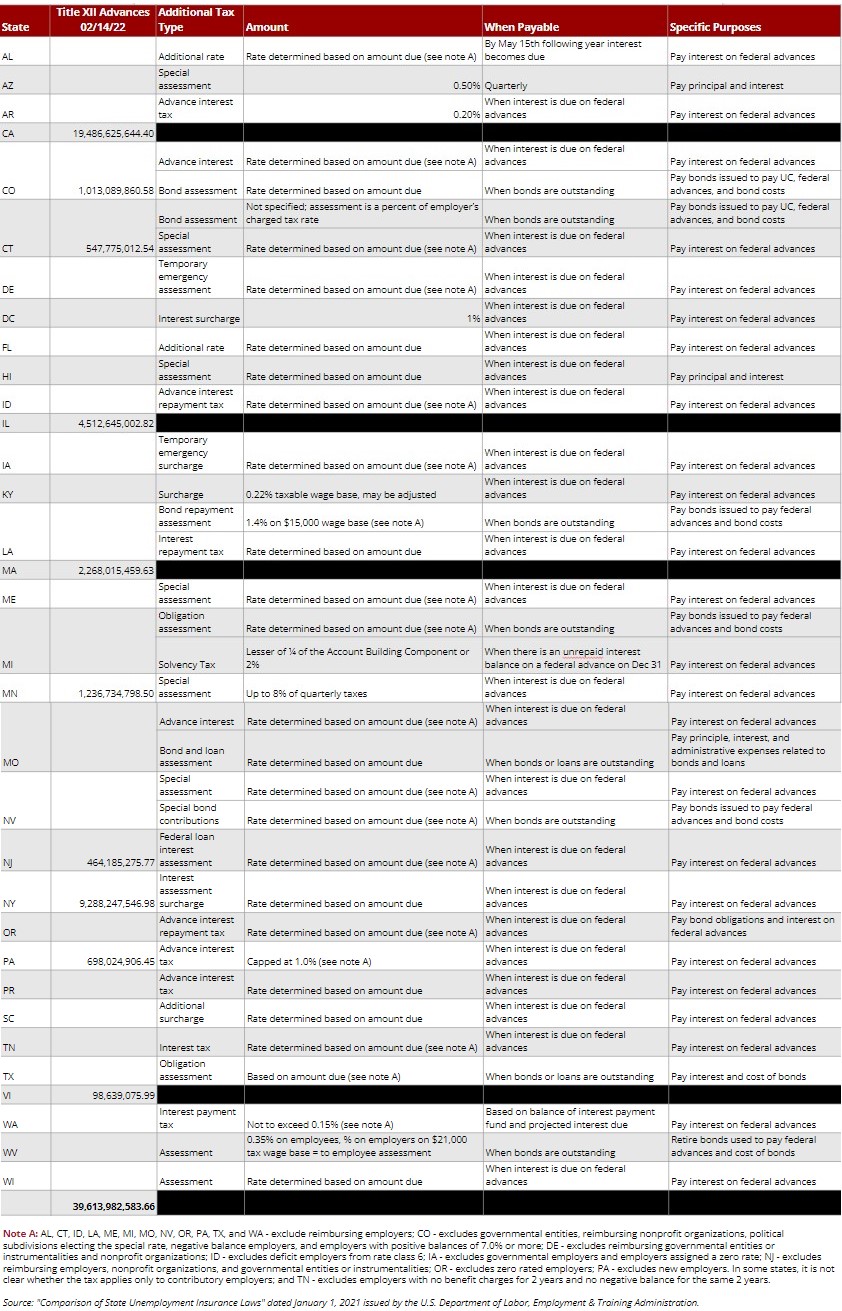

State unemployment tax rates.

. SUTA isnt as cut and dry as the FUTA as it varies by state. And the wage base typically changes from year to year. State SUTA new employer tax rate Employer tax rate range SUTA wage bases Alabama.

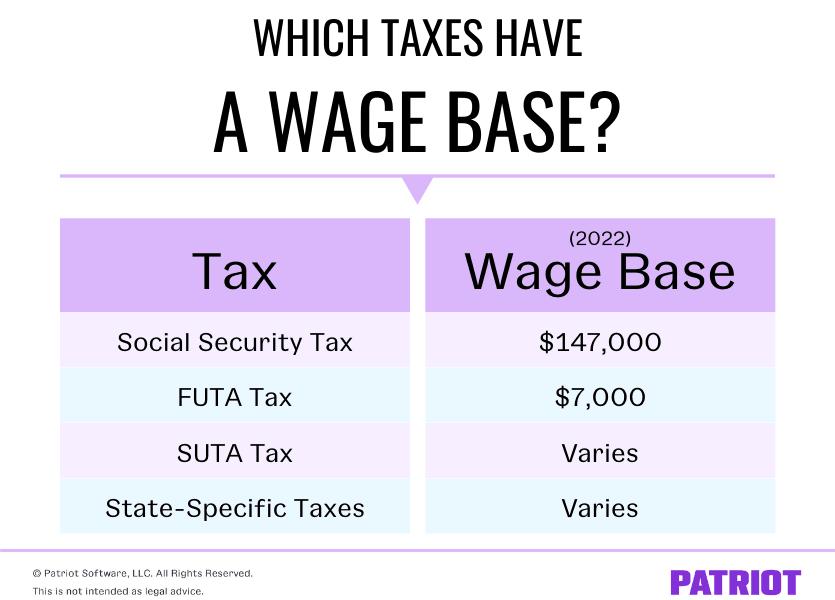

The Federal Unemployment Tax Act FUTA requires that each states taxable wage base must at least equal the FUTA taxable wage base of 7000 per employee and most. Staying with the Texas example the minmax tax rate for 2020 ranged from 031 to 631. Therefore you must pay 238 0034 x 7000 per employee.

Up by 3 percent to a range. Subsequently question is what is the state unemployment tax rate for 2020. To calculate your SUTA tax as a new employer multiply your states new employer tax rate by the wage base.

The maximum FUTA tax an employer must pay per employee per. In 2019 the taxable wage base for employees in Texas is 9000 and the tax rates range from 36 to 636. 51 rows An employers SUTA rate is often referred to as a contribution rate.

The Iowa law stipulates that UI taxes may be collected from employers under eight different tax rate tables and each tax rate table has 21 rate brackets or ranks. The contribution rate. Below is a chart with the.

Companies in construction industries tend to pay higher SUTA tax rates than companies in. The amount of the tax is based on the employees wages and the states unemployment rate. 1 2020 unemployment tax rates for experienced employers are to range from 0255 to 0849.

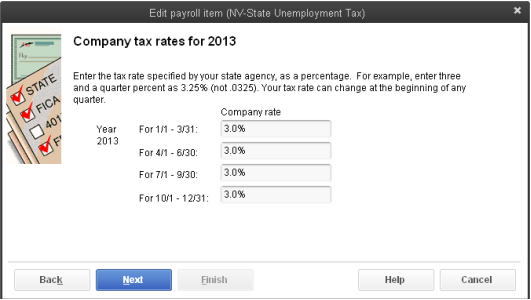

The minimum and maximum tax rates for wages paid in 2022 are as follows based on annual wages up to 7000 per employee. Employers report their tax liability annually on IRS Form 940 but quarterly tax deposits may be required. Tax rate Each state sets a range of minimum and maximum tax rates for SUTA taxes.

Each state has its own limit for the wage base subject to SUTA taxes. Employers in California. This rate is based on an employees gross income and the maximum amount used to calculate SUTA tax.

Rates vary from 0000 to. Assume that your company receives a good assessment and your. Each state sets SUTA rates based on the following.

Fortunately most employers pay little SUTA tax if they havent had employees file unemployment claims. Texas law sets an employers tax rate at their NAICS industry average or 27 percent whichever. Once you know your assigned tax rate youll be able to calculate the amount of SUTA tax youll need to pay for each employee.

0010 10 or 700 per employee. States that raised unemployment tax rates for 2022 and their new ranges include. SUTA tax rates vary depending on the state your business is in or the state your employees work if different.

Imagine you own a California business thats been operating for 25 years.

Suta Tax Rate Increase 2020 State By State Gusto

What Is The Suta Tax And Why Is It Going Up In 2021 Fourth

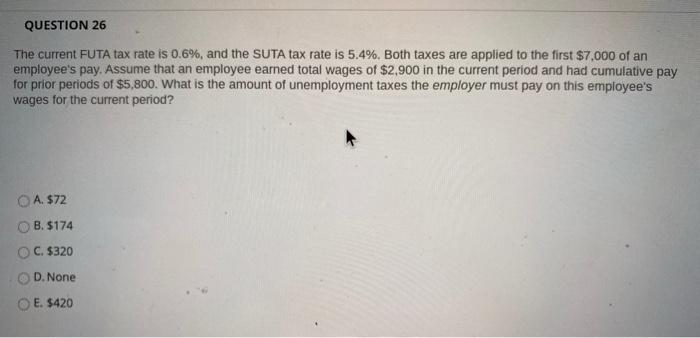

Solved Question 26 The Current Futa Tax Rate Is 0 6 And Chegg Com

New Employer Ui And Construction Employer Tax Rates For 2022 State Of Delaware News

What Is The Futa Tax 2022 Tax Rates And Info Onpay

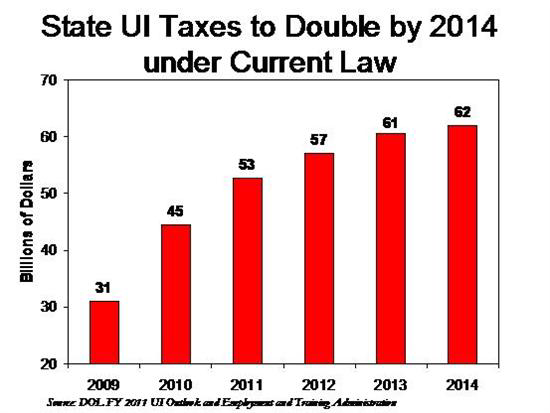

How To Reduce Your Clients Suta Tax Rate In 2014

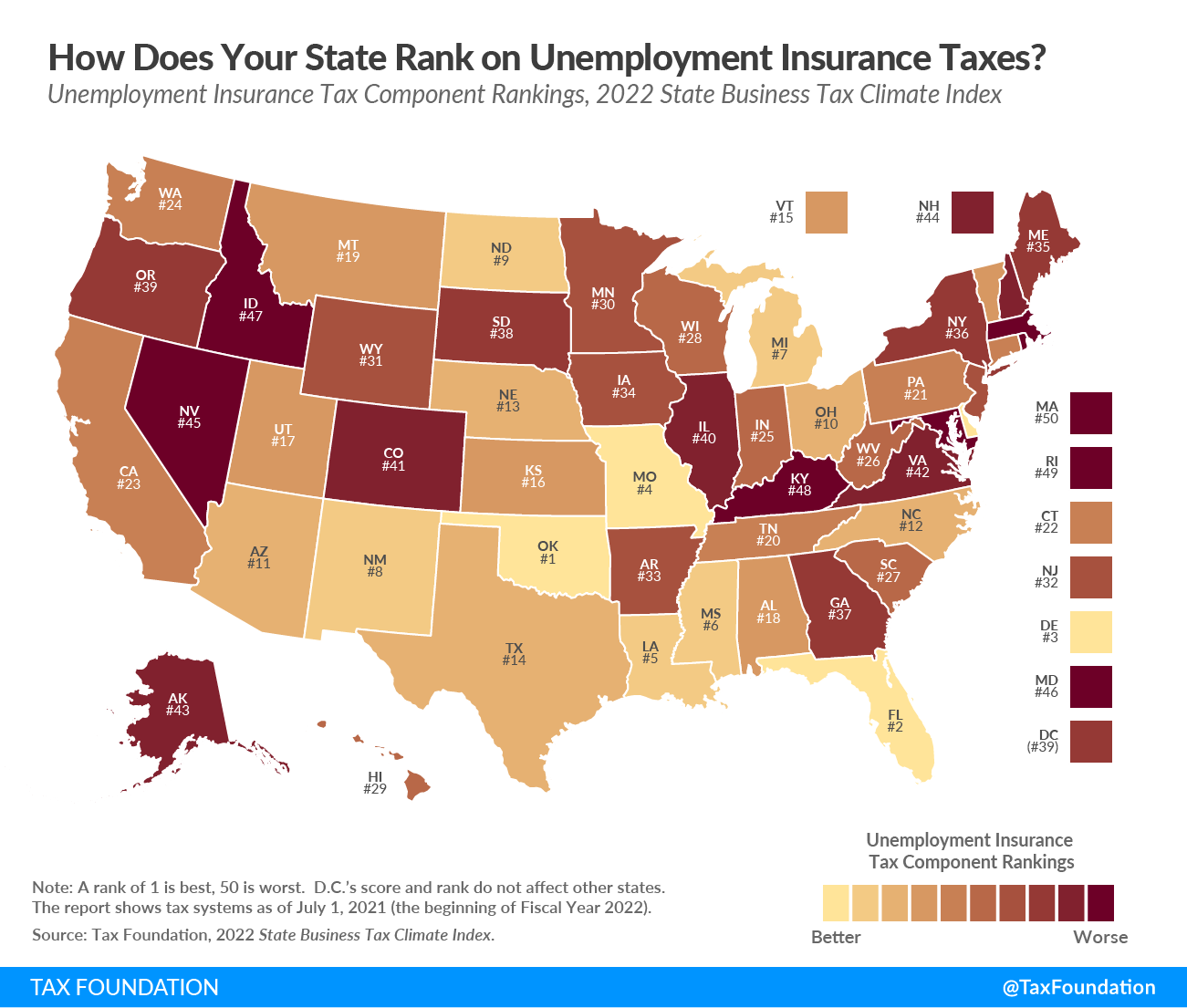

Unemployment Insurance Taxes Tax Foundation

Minnesota Unemployment Insurance Tax Rates 2022 Paylocity

View All Hr Employment Solutions Blogs Workforce Wise Blog

State Unemployment Tax Act Suta Tax Rates 123paystubs Youtube

State Unemployment Insurance Sui Overview

What Is A Wage Base Taxes With Wage Bases More

How Does Your State Rank On Unemployment Insurance Taxes

What Is Futa An Employer S Guide To Unemployment Tax Bench Accounting

Change Sui Tax Rates For Basic Enhanced Standard Payroll

2022 Suta Taxes Here S What You Need To Know Paycom Blog

5 Ways To Lower Your Suta Tax Rate Paytime Payroll

Fast Unemployment Cost Facts For Washington First Nonprofit Companies

Futa Calculation During The Year Zeno Company Has A Suta Tax Rate Of 6 3 The Taxable Payroll For The Year For Futa And Suta Is 77 000 Compute A Course Hero